| 7/8/2019 Ready to buy a home, but intimidated by all the legal jargon in the contracts and don’t know what to expect in the closing process? No need to worry! In this month’s blog we walk you through the closing process and provide you with a small glossary of terms to lessen your home buying trepidation. LOCAL MARKET STATS |

Berkeley County has seen a slight decrease in new listings since this time last year, but an overall increase since the start of 2019, while Charleston County has seen quite a substantial increase in new listings both year to date and in a year’s time. Closed sales have increase substantially in Berkeley County since this time last year as well as year to date, while alternately closed sales in Charleston have decreased in both time frames. Overall sales prices have increased all around in the last year.

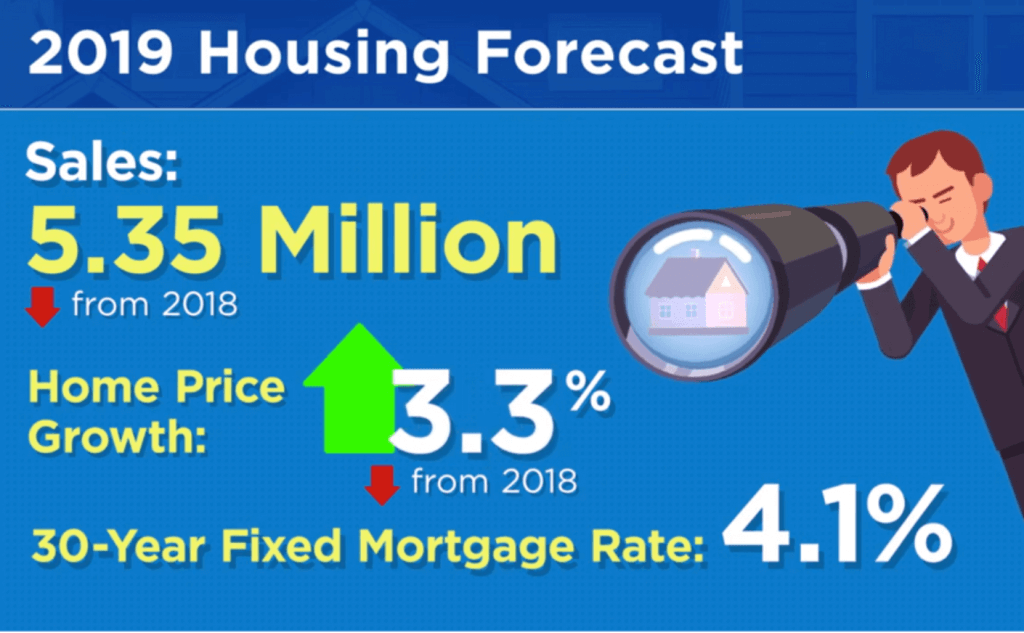

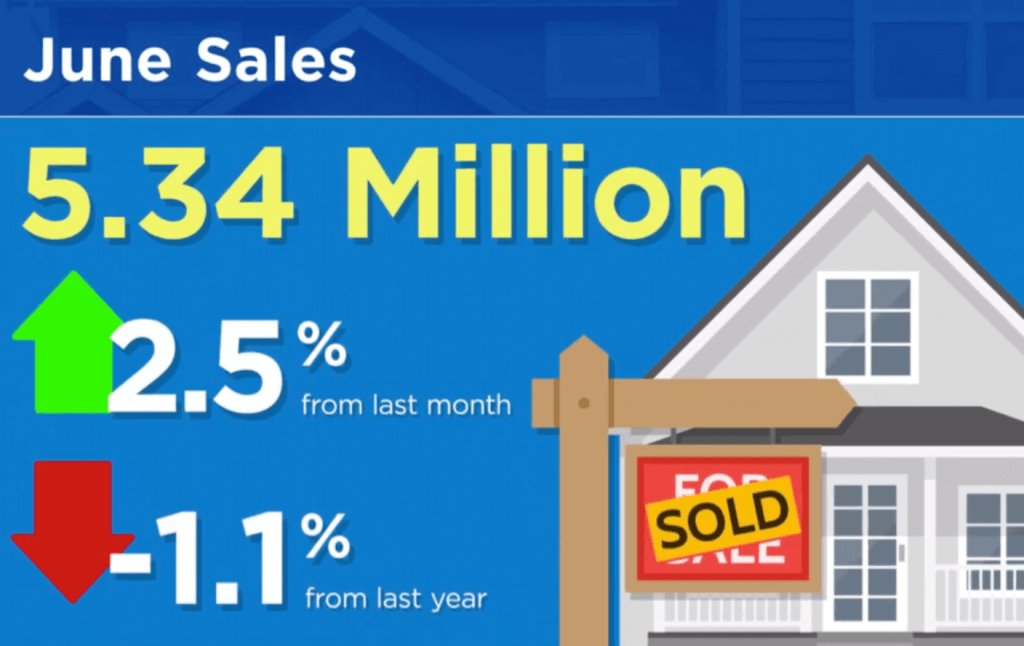

NATIONAL MARKET UPDATE

The median home sale price nationwide for the month of June was 4.8% from last year, at $277,700 while active listings also increased since last year by 2.7% with 1.92 million active listings nationwide.

According to NAR’s Chief Economist Lawrence Yun, demand is high and inventory not high enough to satisfy the buyers in the market, pushing the median home sales price up to a new high.

Other stats:

- Average days on market 26 days

- 1st time home buyers up an astonishing 31% since last year

- Signed contracts are up 1.1%

ROADMAP TO CLOSING DAY

So you are thinking about buying a home, but unsure what to do about all the paperwork, legal jargon and the day of closing. You may be feeling overwhelmed by the sheer amount of things to do , but hopefully this quick debriefing of the closing process and the paperwork involved will help ease your anxiety.

Documents:

The Closing Disclosure (CD) – The Closing Disclosure states the terms of your loan, final closing costs and all other financial terms

The Loan Estimate (LE) – The Loan Estimate outlines the estimated interest rate, monthly payment, estimated taxes and insurance and total closing costs for the loan.

The Initial Escrow Statement – This form contains any payments the lender will pay from your escrow account during the first year of your mortgage. These charges include taxes and insurance.

Mortgage note – This document states your promise to repay the mortgage. It indicates the amount and terms of the loan and what the lender can do if you fail to make payments.

Mortgage – This document secures the note and gives your lender a claim against the home if you fail to live up to the terms of the mortgage note.

Parties:

- Buyer

- Seller

- Buyer’s Real Estate Agent

- Seller’s Real Estate Agent

- Closing Attorney

- Escrow Agent

- Loan Officer

Process:

At the day of closing both the buyer and seller and their respective agents will go to the attorney’s office selected ahead of time, where they will review all documents, gather signatures from the buyer on their loan documents and the payments will be exchanged. Generally buyers will receive the keys to their new home once the deed is recorded. The following are the delineated steps:

Before closing: After a title search has been completed and the title is declared clear, the attorney will issue a title commitment. Paperwork for change of title/deed and title insurance is prepared and a closing date is set. A final cash amount needed from the buyer is calculated and is to be brought to the closing. Finally a last walk-through of the house is done to ensure the property is in the same condition as when the buyer first started the process.

- Buyer and Seller sit at the closing table and sign all applicable documents- for the buyer, all loan documents and for the buyer and seller all transactional documents.

- Buyer pays remaining down payment to the escrow agent.

- The attorney records the deed.

- Buyer receives the keys and unless otherwise agreed with the seller through the contract, takes possession of the property.

LEGAL TERMS EXPLAINED

Cash Reserves- Cash reserves is the money the buyer has left over after the down payment and the closing costs have been paid.

Closing- Closing refers to the meeting that takes place where the sale of the property is finalized. At the closing, buyers and sellers sign the final documents, and the buyer makes the down payment and pays closing costs.

Closing Costs- Closing coasts are in addition to the final home price and generally account for 2-5% of the purchase price, not including the down payment. Examples of closings costs include loan processing costs, title insurance, and excise tax.

Closing Disclosure– Closing Disclosure is a five page document including details on costs associated with the mortgage and must be provided to the consumer three business days before they close on the loan.

Closing Statement– Closing Statement is a summary of the debits and credits in the closing transaction detailing the amounts of which each party (buyer & seller) is entitled.

Loan Estimate– Loan Estimate is a three page document providing information on key features, costs and risks of the loan for which the buyer is applying. This document must be provided to the consumers no later than three business days after they submit a loan application.

Loan Policy – A policy of title insurance issued to the mortgage lender insuring against loss by defects in, liens against, or inability to market the title.

Mortgage– A temporary conditional pledge of property to a creditor as security for the payment of a debt that may be cancelled by payment.

Promissory Note– A written promise to pay or repay a specified sum of money at a stated time, or on demand, to a specific person or institution. In addition to the payment of principal, a promissory note usually includes the payment of interest.

Title– A combination of all the elements that constitute the highest legal right to own, possess, use, control, enjoy, and dispose of real estate or an inheritable right or interest therein.

Title Insurance– Insurance that protects purchasers of real estate and mortgages against loss from defective titles, liens and encumbrances.

ADDITIONAL RESOURCES

Consumerfinance.gov – Closing Disclosures

Consumer Financial Protection Bureau – Closing Forms Guide

Consumer Financial Protection Bureau – Mortgage Checklist